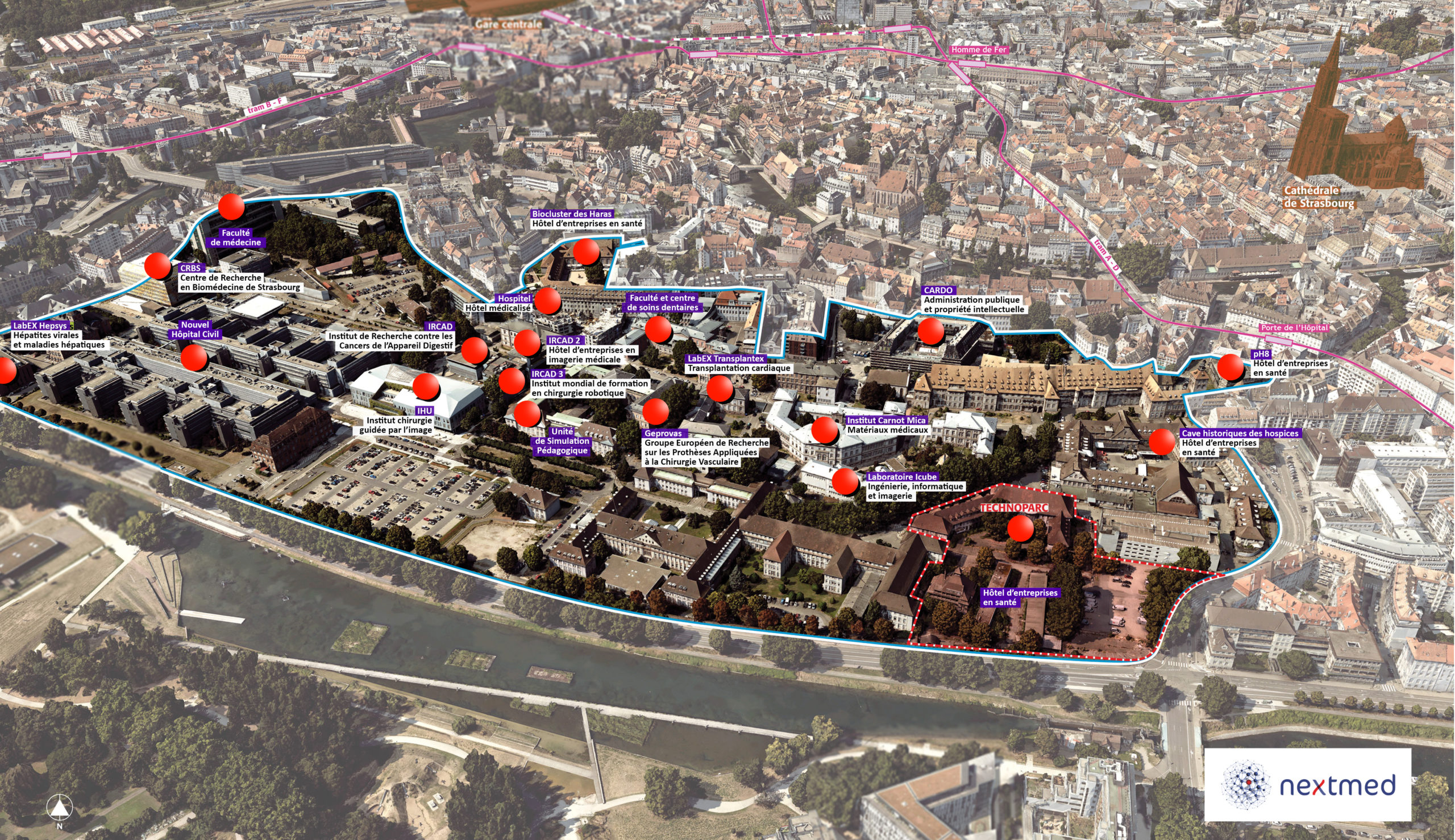

Accélérateur d’innovations en santé

Situé au cœur de Strasbourg, nextmed réunit sur plus de 30 hectares l’ensemble des médecins, chercheurs, entrepreneurs et patients pour construire la santé du futur et imaginer les solutions innovantes de prises en charge des patients notamment par le biais du numérique et l’IA.

de la chirurgie guidée par l'image

N°

0

mondial

sociétés dans la santé

+ de

0

en science de la vie

0

Prix Nobel

étudiants chaque année

0

pour l'accueil d'entreprises innovantes en santé

0

m2

incubateur santé de France

0

er

Vous avez un projet ?

Dernières actualités

Sobero : nouvelle app made in Strasbourg

Kwit, leader mondial des apps de sevrage tabagique, lance Sobero : nouvelle app pour mieux contrôler, réduire ou arrêter de…

Une formation hybride pour les métiers du futur : EVE

Porté par la Pr. Perretta et ses équipes à l’IHU, EVE est né de l’ambition de développer un enseignement moderne…

Pr. Silvana Perretta, chirurgienne innovatrice au service des patients

Pr. Silvana Perretta La Professeure Silvana Perretta est vice-présidente de l’IRCAD et directrice de la formation à l’IHU. Décorée cette…

Transgène : l'immunothérapie contre les cancers

C'est une première mondiale qui se déroule à Strasbourg. Transgene, société de biotechnologie basée sur le Parc d'Innovation de Strasbourg,…

PredictEST, l'outil de prévision du COVID19

PredictEST, outil de prévision de l’évolution du COVID19, a été conçu par la plateforme INESIA by PRIESM et l’IHU de…

Témoignages

Voir tous

Le concept de l’IRCAD dépasse l’excellence dans la recherche innovante, l’éducation et les soins de haut niveau dédiés à la chirurgie mini-invasive. Depuis quelques années, l’une de nos priorités est de diffuser des technologies développées à l’institut, par la formation et le transfert des technologies. Dans ce contexte, le campus nextmed est un élément essentiel de cette stratégie de développement. Il va permettre d’attirer non seulement des géants de l’industrie mais également des PME et startups du dispositif médical. L’IRCAD, sera donc au cœur d’un regroupement de talents et compétence, synonyme de développement économique et d’innovations thérapeutiques, qui, sans nextmed ne pourrait pas exister.

Dianosic, startup Medtech dédiée à l’ORL, est profondément ancrée dans le Grand Est. Au coeur d’un territoire dévoué à l’innovation, au positionnement géographique idéal, doté de compétences fortes en santé (CHU, IRCAD, IHU) et de partenaires de grande qualité (SEMIA, Biovalley France, SATT Conectus, BPI, Région, Eurométropole, Capital Grand Est, CCI et ADIRA), nous disposons des conditions propices à notre développement. Nextmed est une pièce essentielle de ce puzzle et contribuera à l’émergence des champions de demain tout en renforçant le statut de «capitale des Medtechs» de Strasbourg.

RDS est une startup franco-américaine qui développe une nouvelle génération de dispositifs médicaux connectés. Le projet a démarré en Californie, et nous avons décidé en 2019 de le poursuivre à Strasbourg compte-tenu de l’excellence et du dynamisme de son écosystème médical, scientifique et industriel. Nextmed est pour nous un projet clé qui accélère encore plus fortement cette dynamique et au sein duquel nous souhaitons nous inscrire.

Depuis 2017 HypnoVR a pu bénéficier du formidable écosystème de l’Eurométropole et de la Région. Rejoindre nextmed, épicentre de l’écosystème MedTech du territoire, ouvre la voie à de formidables opportunités croisées de partage d’expérience et d’accélération pour HypnoVR.

Être partie prenante de nextmed, la “Silicone Valley” Medtech française sera un atout indiscutable pour TokTokDoc.

Précédent

Suivant